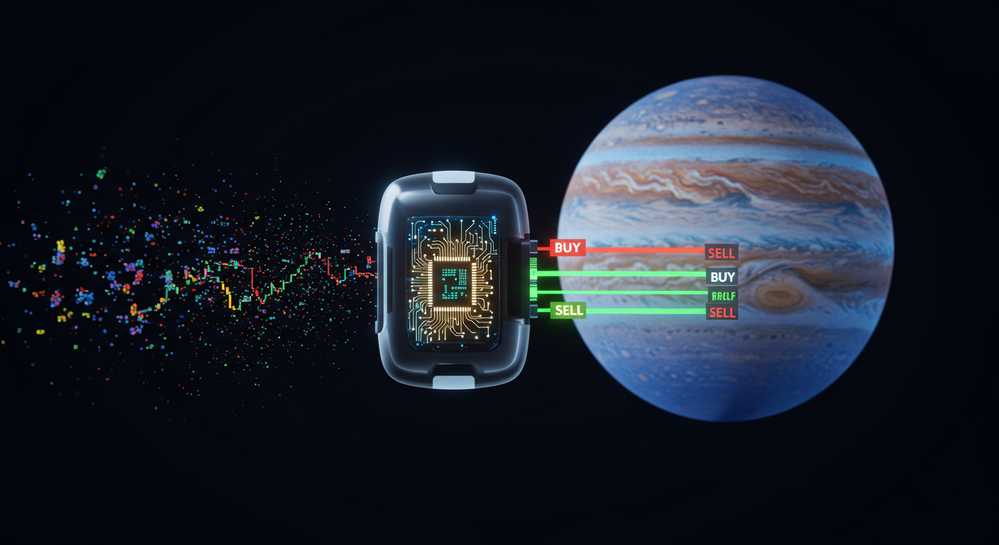

Manually executing trades in the fast-paced Solana ecosystem can be challenging. A jupiter trading bot offers a powerful solution, enabling you to automate your strategies on Solana’s largest liquidity aggregator. This tool is designed to execute transactions based on predefined parameters, helping you capitalize on market opportunities 24/7 without being glued to your screen. It is an essential instrument for both novice and experienced traders looking to enhance their efficiency.

Contents

What is a Jupiter trading bot

Core function of a jupiter trading bot

A Jupiter trading bot is an automated software program designed to interact directly with the Jupiter aggregator on the Solana blockchain. Jupiter is not a typical decentralized exchange (DEX). Instead, it functions as a powerful aggregator, pooling liquidity from various sources across Solana to offer users the best possible swap rates. The bot leverages this infrastructure to execute your trading strategies automatically and efficiently.

Instead of manually placing orders, a trader configures the bot with a specific set of rules based on price, indicators, or other conditions. Once activated, the bot monitors the market and executes trades on your behalf through Jupiter whenever its predefined conditions are met. This enables high-speed, emotionless trading, which is crucial for capitalizing on opportunities in the volatile crypto market. It unlocks powerful strategies, including some forms of arbitrage trading bots that require scanning multiple liquidity sources simultaneously.

How do Jupiter trading bots work

The mechanics behind a jupiter trading bot

A Jupiter trading bot operates by connecting to your wallet through a secure Application Programming Interface (API). This key grants the bot permission to execute trades but crucially, it cannot access withdrawal functions. This ensures your funds remain secure while the bot works on your behalf, following a simple if-then logic for every action.

The entire automated process can be broken down into four key stages:

- Configuration: The user defines all trading parameters, including the token pair and strategy. This is where you can implement popular methods like Dollar-Cost Averaging or specialized grid trading bots.

- Market Analysis: The bot continuously scans market data from Jupiter in real-time. It tracks price movements and liquidity shifts across the Solana ecosystem.

- Trade Execution: When market conditions align with your predefined rules, the bot instantly executes the trade. It leverages Jupiter to find the most efficient swap route across multiple DEXs.

- Monitoring: Every transaction is logged, providing detailed reports on your bot’s performance and profitability.

Key features to look for in a Jupiter trading bot

Evaluating a jupiter trading bot

Selecting the right Jupiter trading bot is crucial for success. Your choice should hinge on a few core features that guarantee security, performance, and usability. A careful evaluation protects your capital and maximizes your strategic potential on the Solana network. Prioritizing these elements ensures you choose a reliable and effective tool for your automated trading journey.

Here are the essential features to look for:

- Security: Non-custodial operation via secure API keys is non-negotiable. The bot should never directly control or hold your funds.

- Strategy Variety: A good bot offers both pre-built strategies and full customization. This flexibility adapts to your specific goals and risk tolerance.

- Backtesting Capabilities: The ability to test strategies against historical data is critical. It helps you refine your approach before deploying real capital.

- Speed and Reliability: On Solana, execution speed is everything. The bot must be fast and stable to minimize slippage and capture fleeting market opportunities.

- Transparent Pricing: Ensure the fee structure is clear and upfront. Hidden costs can quickly erode your trading profits.

Benefits and risks of automated trading on Jupiter

Using a Jupiter trading bot offers powerful advantages, but it also carries inherent risks that every trader must understand. A balanced perspective is essential to leverage these tools effectively without exposing your portfolio to unnecessary losses. Success depends on weighing the pros against the cons for your specific strategy.

Key benefits of automation

- 24/7 Operation: The bot trades around the clock, ensuring you never miss an opportunity, even while you are offline.

- Emotionless Trading: Automation removes fear and greed from your decisions, executing trades based purely on logic and strategy.

- Enhanced Speed: Bots react to market changes and execute trades faster than any human, a critical edge in volatile markets.

- Deep Liquidity Access: By operating on Jupiter, the bot taps into the entire Solana DEX ecosystem for better prices and lower slippage.

Potential risks to consider

- Market Volatility: A bot follows its programming and cannot predict sudden market crashes. A solid stop-loss strategy is essential.

- Technical Failures: Connectivity issues, API downtime, or software bugs can cause a bot to malfunction or miss trades.

- Improper Configuration: A poorly configured bot can lead to significant losses. You must understand every parameter before deploying real funds.

A Jupiter trading bot is a formidable tool for automating your crypto strategies on Solana, offering speed, efficiency, and emotion-free execution. It capitalizes on Jupiter’s deep liquidity to optimize your trades. However, its effectiveness depends on proper configuration, a clear strategy, and a thorough understanding of the associated risks. For those ready to elevate their trading, exploring a reliable platform is the next logical step. Discover advanced trading solutions at Crypto Copy Trading Platform.